Sunday, October 9, 2016

Sovereign wealth funds pull $90bn from asset managers

Article in the FT:

State-backed investment vehicles grapple with low commodity prices and disappointing returns.

Read on here.

Tuesday, October 4, 2016

New OxCarre research: Saving Alberta's Resource Revenues: Role of intergenerational and liquidity funds

New OxCarre research from:

Ton van der Bremer (University of Edinburgh) and Rick van der Ploeg (OxCarre)

Saving Alberta's Resource Revenues: Role of intergenerational and liquidity funds

Abstract:

We use a welfare-based intertemporal stochastic optimization model and historical data to estimate the size of the optimal intergenerational and liquidity funds and the corresponding resource dividend available to the government of the Canadian province Alberta. To first-order of approximation, this dividend should be a constant fraction of total above- and below-ground wealth, complemented by additional precautionary savings at initial times to build up a small liquidity fund to cope with oil price volatility. The ongoing dividend equals approximately 30 per cent of government revenue and requires building assets of approximately 40 per cent of GDP in 2030, 100 per cent of GDP in 2050 and 165 per cent in 2100. Finally, the effect of the recent plunge in oil prices on our estimates is examined. Our recommendations are in stark contrast with historical and current government policy.

We use a welfare-based intertemporal stochastic optimization model and historical data to estimate the size of the optimal intergenerational and liquidity funds and the corresponding resource dividend available to the government of the Canadian province Alberta. To first-order of approximation, this dividend should be a constant fraction of total above- and below-ground wealth, complemented by additional precautionary savings at initial times to build up a small liquidity fund to cope with oil price volatility. The ongoing dividend equals approximately 30 per cent of government revenue and requires building assets of approximately 40 per cent of GDP in 2030, 100 per cent of GDP in 2050 and 165 per cent in 2100. Finally, the effect of the recent plunge in oil prices on our estimates is examined. Our recommendations are in stark contrast with historical and current government policy.

Sunday, September 25, 2016

Mining matters: Natural resource extraction and local business constraints

Research on VOXEU from

Ralph de Haas (EBRD) and Steven Poelhekke (VU Amsterdam):

The extraordinary expansion in global mining activity over the last two decades, and its increasing concentration in emerging markets, has reignited the debate over the impact of mining on local economic activity. This column analyses how the presence of nearby mines influences firms in eight countries with large manufacturing and mining sectors. Mines are found to out-compete local manufacturing firms for inputs, labour, and infrastructure. However, mining activity is found to improve the business environment on a wider geographic scale.

Tuesday, September 20, 2016

New OxCarre research: Resource discoveries and FDI bonanzas

New OxCarre research from:

Gerhard Toews (OxCarre) and Pierre-Louis Vezina (King's College London)

Abstract:

This paper examines the effect of giant oil and gas discoveries on foreign direct

investment in developing economies using a new project-level dataset. We document

a large increase in non-extraction FDI in the 2 years following a giant discovery, an

event which is unpredictable due to the uncertain nature of exploration. We find

that FDI inows increase by 73% and that this wave is driven by a 37% increase

in the number of FDI projects as well as a 22% increases in source countries and

a 17% increase in target sectors. We interpret this FDI response as evidence for the

news-driven business-cycle hypothesis within a developing country setting and highlight

FDI bonanzas as an important development channel for resource rich economies.

Tuesday, September 13, 2016

Mongolia: Living from loan to loan

Article in the FT:

Since the commodities boom turned to bust, the country has traded self-sufficiency for indebtedness.

Read on here.

Wednesday, July 27, 2016

Poverty Maps and Darkness

From the updated OxCARRE paper [pdf, oxcarre.ox.ac.uk], Left in the Dark of Brock Smith [brockdsmith.com] and Sam Wills [wordpress.com] come these interesting maps on rural poverty.

Read on at Sam's website [wordpress.com]

Friday, July 15, 2016

New Research: Labor market dynamics and the unconventional natural gas boom: Evidence from the Marcellus region

Timothy M. Komarek ([sites.google.com], Old Dominion University) writes on

Labor market dynamics and the unconventional natural gas boom: Evidence from the Marcellus region

Labor market dynamics and the unconventional natural gas boom: Evidence from the Marcellus region

Abstract

The energy extraction boom of the mid 2000s impacted local economies in areas with substantial shale oil and gas reserves. I examine the impact of the energy boom on the labor market by exploiting a natural experiment in the Marcellus region. In particular, I compare counties with fracking activity in Pennsylvania, Ohio and West Virginia to the control group of counties in New York, which imposed a moratorium and later ban on fracking. I look at how the benefits to the labor demand shock are shared between industries as well as how employment and wages in related industries adjust over the course of the resource boom. The results suggest total employment and wages per job increase by 7% and 11% respectively above pre-boom levels in the three years after the boom, but decline after 4 years or more. The results also show significant positive spillovers to related sectors, such as construction, transportation, retail trade and accommodations. However, there is no evidence of the so called ‘resource curse’ crowding out employment or increasing wages in manufacturing.Published in Resource and Energy Economics, Volume 45, August 2016, Pages 1–17, available here [sciencedirect.com].

Wednesday, July 13, 2016

New research: Resource revenue management and wealth neutrality in Norway

Klaus Mohn ([uis.no], University of Stavanger) writes on

Resource revenue management and wealth neutrality in Norway

Abstract:

Published in Energy Policy, Volume 96, September 2016, Pages 446–457, find here [sciencedirect.com]

An important idea behind the Norwegian oil fund mechanism and the fiscal spending rule is to protect the non-oil economy from the adverse effects of excessive spending of resource revenues over the Government budget. A critical assumption in this respect is that public sector saving is not being offset by private sector dissaving, which is at stake with the hypothesis of Ricardian equivalence. Based on a framework of co-integrating saving rates, this model provides an empirical test of the Ricardian equivalence hypothesis on Norwegian time series data. Although the model rejects the strong-form presence of Ricardian equivalence, results indicate that the Norwegian approach does not fully succeed in separating spending of resource revenues from the accrual of the same revenues.

Published in Energy Policy, Volume 96, September 2016, Pages 446–457, find here [sciencedirect.com]

Thursday, June 30, 2016

FT: Big Oil: From black to green

From the FT: Big Oil: From black to green

Read on here

Despite pressure to develop renewables, many energy majors see more money in traditional markets

Highlighting the different attempts of big oil companies to diversify to green energy, with a distinct difference apparently between European and US companies.

Monday, June 20, 2016

New OxCARRE Research: Stranded assets, the social cost of carbon, and directed technical change: Macroeconomic dynamics of optimal climate policy

New OxCARRE research from

Frederick van der Ploeg ([ox.ac.uk], OxCARRE) and Armon Rezai ([wu.ac.at], WU - Vienna University of Economics and Business)

Stranded assets, the social cost of carbon, and directed technical change: Macroeconomic dynamics of optimal climate policy

Abstract

Frederick van der Ploeg ([ox.ac.uk], OxCARRE) and Armon Rezai ([wu.ac.at], WU - Vienna University of Economics and Business)

Stranded assets, the social cost of carbon, and directed technical change: Macroeconomic dynamics of optimal climate policy

Abstract

The tractable general equilibrium model developed by Golosov et al. (2014), GHKT for short, is modified to allow for stock-dependent fossil fuel extraction costs and partial exhaustion of fossil fuel reserves, a negative impact of global warming on growth, mean reversion in climate damages, steady labour-augmenting technical progress, specific green technical progress driven by learning by doing, population growth, and a direct effect of the stock of atmospheric carbon on instantaneous welfare. We characterize the social optimum and derive simple rule for both the optimal carbon tax and the renewable energy subsidy, and characterize the optimal amount of untapped fossil fuel.Available here [ox.ac.uk].

Wednesday, May 25, 2016

New OxCARRE research: Mining Matters; Natural Resource Extraction and Local Business Constraints

Ralph De Haas ([ebrd.com] European Bank for Reconstruction and Development; Tilburg University) and Steven Poelhekke ([sites.google.com] Vrije Universiteit Amsterdam; De Nederlandsche Bank)

Mining Matters; Natural Resource Extraction and Local Business Constraints

Read on here [oxcarre.ox.ac.uk]

Mining Matters; Natural Resource Extraction and Local Business Constraints

We estimate the impact of local mining activity on the business constraints experienced by 22,150 firms across eight resource-rich countries. We find that the presence of active mines deteriorates the business environment in the immediate vicinity (<20 km) of a firm but relaxes business constraints of more distant firms. The negative local impact of mining is concentrated among firms in tradable sectors whose access to inputs and infrastructure becomes more constrained. This deterioration of the local business environment adversely affects firm growth and is in line with a natural resource curse at the sub-national level.

Read on here [oxcarre.ox.ac.uk]

Tuesday, May 24, 2016

New OxCARRE Research: Boom Goes The Price: Giant resource discoveries and real exchange rate appreciation

Gerhard Toews ([sites.google.com] OxCARRE, University of Oxford) and OxCARRE alumni Torfinn Harding ([sites.google.com] NHH Norwegian School of Economics) and Radek Stefanski ([weebly.com] University of St Andrews) write on

Boom Goes The Price: Giant resource discoveries and real exchange rate appreciation

Abstract:

Boom Goes The Price: Giant resource discoveries and real exchange rate appreciation

Abstract:

We estimate the effect of giant oil and gas discoveries on bilateral real exchange rates. The size and plausibly exogenous timing of such discoveries make them ideal for identifying the effects of an anticipated resource boom on prices. We find that a giant discovery with the value of a country’s GDP increases the real exchange rate by 14% within 10 years following the discovery. The appreciation is nearly exclusively driven by an appreciation of the prices of non-tradable goods. We show that these empirical results are qualitatively and quantitatively in line with a calibrated model with forward looking behaviour and Dutch disease dynamics.Full paper available here. [oxcarre.ox.ac.uk]

Tuesday, May 17, 2016

New OxCARRE research: Fossil fuel producers under threat

Rick van der Ploeg writes on

Fossil fuel producers under threat

Fossil fuel producers under threat

Oil and gas producers face three threats: prolonged low oil and gas prices, tightening of climate policy and a tough budget on cumulative carbon emissions, and technological innovation producing cheap substitutes for oil and gas. These threats pose real risks of putting oil and gas producers out of business. They lead to the problem of stranded assets and a significant downward valuation of oil and gas producers. This calls for divesting from and shorting coal, oil, and gas. The economies of oil- and gas-rich countries are typically in a deplorable state, since they did not use their past windfalls to build up buffers and invest in a diversified economy. More rapacious depletion of their oil and gas reserves will not help. After the crash in oil and gas prices these countries are facing serious problems and it is difficult to see how they will cope with the outlined threats.Published in Oxford Review of Economic Policy, available here [oxrep.oxfordjournals.org].

Monday, May 16, 2016

New OxCARRE working papers on resource funds, deforestation, and infrastructure

New OxCARRE research available at the website [oxcarre.ox.ac.uk]:

Anthony J. Venables ([sites.google.com] OxCARRE) and Samuel E. Wills ([samuelwills.wordpress.com] OxCARRE) write on

Resource Funds: stabilizing, parking, and inter-generational transfer

Liana O. Anderson ([liana-anderson.org] CEMADEN), Samantha De Martino (University of Sussex), Torfinn Harding ([sites.google.com, NHH Bergen), Karlygash Kuralbayeva ([lse.ac.uk], LSE) and Andre Lima (University of Maryland)

The Effects of Land Use Regulation on Deforestation: Evidence from the Brazilian Amazon

Rabah Arezki ([rabaharezki.com], IMF) and Amadou Sy ([brookings.edu] Brookings Institution)

Financing Africa’s Infrastructure Deficit: From Development Banking to Long-Term Investing

Anthony J. Venables ([sites.google.com] OxCARRE) and Samuel E. Wills ([samuelwills.wordpress.com] OxCARRE) write on

Resource Funds: stabilizing, parking, and inter-generational transfer

The paper explores strategies for managing revenue from natural resources, focusing on the balance between domestic and foreign asset accumulation. It suggests that domestic asset accumulation is the priority in developing countries, while there are three motives for accumulating foreign assets; inter-generational transfer, temporary ‘parking’ of funds, and stabilisation. The paper argues that the first of these is inappropriate for low income countries. The second is required if it is difficult to absorb extra spending in the domestic economy and takes time to build up domestic investment. The third is important, and depends on the extent to which the economy has other ways of adjusting to shocks.Available here [oxcarre.ox.ac.uk, pdf].

Liana O. Anderson ([liana-anderson.org] CEMADEN), Samantha De Martino (University of Sussex), Torfinn Harding ([sites.google.com, NHH Bergen), Karlygash Kuralbayeva ([lse.ac.uk], LSE) and Andre Lima (University of Maryland)

The Effects of Land Use Regulation on Deforestation: Evidence from the Brazilian Amazon

To reduce deforestation rates in the Amazon, Brazil established in the period 2004-2010 conservation zones covering an area 1.5 times the size of Germany. In the same period, Brazil experienced a large reduction in deforestation rates. By combining satellite data on deforestation with data on the location and timing of the conservation zones, we provide spatial regression discontinuity estimates and difference-in-difference estimates indicating that the policy cannot explain the large reduction in deforestation rates. The reason is that the zones are located in areas where agricultural production is likely to be unprofitable. We also provide evidence that zones reduce deforestation if the incentives for municipalities to reduce deforestation are high. We rationalize these finding with a spatial economics model of land use, with endogenous location of conservation zones and imperfect enforcement. Our findings point to the need for other explanations than the conservation zones to explain the sharp decline in deforestation rates in the Brazilian Amazon since 2004.Available here [oxcarre.ox.ac.uk].

Rabah Arezki ([rabaharezki.com], IMF) and Amadou Sy ([brookings.edu] Brookings Institution)

Financing Africa’s Infrastructure Deficit: From Development Banking to Long-Term Investing

This paper studies the appropriate financing structure of infrastructure investment in Africa. It starts with a description of recent initiatives to scale up infrastructure investment in Africa. The paper then uses insights from the literature on informed vs. arm’s length debt to discuss the structure of infrastructure financing. Considering the differences in investors’ preferences that Africa faces, the paper argues that continent’s success to fill its greenfield and hence risky infrastructure gap hinges upon a delicate balancing act between development banking and institutional long-term investment. In a first phase, development banks which have both the flexibility and expertise should help finance the riskier phases of large greenfield infrastructure projects. In a second phase, development banks should disengage and offload their mature brownfield projects to pave the way for a viable engagement of long term institutional investors such as sovereign wealth funds. In order to promote an Africa wide infrastructure bond markets where the latter could play a critical role, the enhancement of Africa’s legal and regulatory framework should however start now.read on here [oxcarre.ox.ac.uk].

Saturday, May 14, 2016

Journal of Development Studies special issue on natural resources

The Journal of Development Studies is brining out a special issue on Natural resources with the following papers:

Elissaios Papyrakis ([uea.ac.uk] University of East Anglia)

The Resource Curse - What Have We Learned from Two Decades of Intensive Research: Introduction to the Special Issue

Frederick Van Der Ploeg ([oxcarre.ox.ac.uk] OxCARRE, University of Oxford) and Associate researcher Steven Poelhekke ([sites.google.com, Vrije Universiteit Amsterdam)

Elissaios Papyrakis ([uea.ac.uk] University of East Anglia), Matthias Rieger ([weebly.com] Erasmus University Rotterdam) & Emma Gilberthorpe ([uea.ac.uk] University of East Anglia)

Corruption and the Extractive Industries Transparency Initiative

Doug Porter ([worldbank.org] Worldbank) & Michael Watts ([berkeley.edu] UC Berkeley Geography)

Gavin Hilson ([surrey.ac.uk] University of Surrey) & Tim Laing (University of the West Indies)

Guyana Gold: A Unique Resource Curse?

Elissaios Papyrakis ([uea.ac.uk] University of East Anglia)

The Resource Curse - What Have We Learned from Two Decades of Intensive Research: Introduction to the Special Issue

There has been increasing interest in the so-called ‘resource curse’, that is the tendency of resource-rich countries to underperform in several development outcomes. This has generated a mountain of (often contradictory) evidence leaving many floundering in the flood of information. This special issue compiles eight papers from some of the most prominent contributors to this literature, combining original research with critical reflection on the current stock of knowledge. The studies collectively emphasise the complexities and conditionalities of the ‘curse’ – its presence/intensity is largely context-specific, depending on the type of resources, socio-political institutions and linkages with the rest of the economy.read on here [tandfonline.com].

Frederick Van Der Ploeg ([oxcarre.ox.ac.uk] OxCARRE, University of Oxford) and Associate researcher Steven Poelhekke ([sites.google.com, Vrije Universiteit Amsterdam)

The Impact of Natural Resources: Survey of Recent Quantitative Evidence

The cross-country empirical evidence for the natural resource curse is ample, but unfortunately fraught with econometric difficulties. A recent wave of studies on measuring the impact of natural resource windfalls on the economy exploits novel datasets such as giant oil discoveries to identify effects of windfalls, uses natural experiments and within-country econometric analysis, and estimates local impacts. These studies offer more hope in the search of quantitative evidence.

Read on here [tandfonline.com].

Emma Gilberthorpe ([uea.ac.uk] University of East Anglia) & Dinah Rajak ([sussex.ac.uk] University of Sussex)

The Anthropology of Extraction: Critical Perspectives on the Resource Curse

Emma Gilberthorpe ([uea.ac.uk] University of East Anglia) & Dinah Rajak ([sussex.ac.uk] University of Sussex)

The Anthropology of Extraction: Critical Perspectives on the Resource Curse

Attempts to address the resource curse remain focussed on revenue management, seeking technical solutions to political problems over examinations of relations of power. In this paper, we provide a review of the contribution anthropological research has made over the past decade to understanding the dynamic interplay of social relations, economic interests and struggles over power at stake in the political economy of extraction. In doing so, we show how the constellation of subaltern and elite agency at work within processes of resource extraction is vital in order to confront the complexities, incompatibilities, and inequities in the exploitation of mineral resources.read on here [tandfonline.com].

Elissaios Papyrakis ([uea.ac.uk] University of East Anglia), Matthias Rieger ([weebly.com] Erasmus University Rotterdam) & Emma Gilberthorpe ([uea.ac.uk] University of East Anglia)

Corruption and the Extractive Industries Transparency Initiative

The Extractive Industries Transparency Initiative (EITI) has received much attention as a scheme that can help reduce corruption in mineral-rich developing economies. To our knowledge, this paper provides the first empirical attempt (using panel data) to explore how EITI membership links to changes in corruption levels. We also examine whether the different stages in EITI implementation (initial commitment, candidature, full compliance) influence the pace of changes in corruption. We find that EITI membership offers, on the whole, a shielding mechanism against the general tendency of mineral-rich countries to experience increases in corruption over time.read on here [tandfonline.com].

Doug Porter ([worldbank.org] Worldbank) & Michael Watts ([berkeley.edu] UC Berkeley Geography)

Righting the Resource Curse: Institutional Politics and State Capabilities in Edo State, Nigeria

R. M. Auty ([lancaster.ac.uk] University of Lancaster)

Natural Resources and Small Island Economies: Mauritius and Trinidad and Tobago

The poor record of liberal reforms sponsored by the international community in postcolonial settings underscores the real politik of institutional change. What we call a ‘new normal’ in development policy and practice foregrounds the role of agency – leadership, networks of connectors and convenors, entrepreneurs and activists – but it has less to say about the political and economic conditions of possibility in which agents operate. The putative powers of agency seem most challenged in contexts of extreme resource dependency and the resource curse. The particular case of Edo, a state in the oil rich Niger delta region of Nigeria, illustrates the intersection of agency and structural conditions to show how ‘asymmetric capabilities’ can emerge to create, constrain and make possible particular reform options.Read on here [tandfonline.com].

R. M. Auty ([lancaster.ac.uk] University of Lancaster)

Natural Resources and Small Island Economies: Mauritius and Trinidad and Tobago

Historically, small economies, especially resource-rich ones, underperformed on average relative to their larger counterparts. Small island economies appear still more disadvantaged due to remoteness from both markets and agglomeration economies. Yet a comparison of two small island economies with similar initial conditions other than their mineral endowment suggests that policy outweighs size, isolation and resource endowment in determining economic performance. Resource-poor Mauritius adopted an unfashionable policy of export manufacturing that systematically eliminated surplus labour, which drove economic diversification that sustained rapid GDP growth and political maturation. Like most resource-rich economies, Trinidad and Tobago pursued policies that absorbed rent too rapidly, which impeded diversification and created an illusory prosperity vulnerable to collapse.Read on here [tandfonline.com].

Gavin Hilson ([surrey.ac.uk] University of Surrey) & Tim Laing (University of the West Indies)

Guyana Gold: A Unique Resource Curse?

This article offers explanations for the underwhelming economic performance of Guyana, a country heavily dependent on the revenue generated from gold mining. Here, government intervention has spawned a gold mining sector which today is comprised exclusively of local small and medium-scale operators. But whilst this rather unique model appears to be the ideal blueprint for facilitating local development, the country seems to be experiencing many of the same setbacks that have beset scores of other resource-rich developing world economies. Unless these problems are anticipated, properly diagnosed and appropriately tackled, a resource curse-type outcome is inevitable, irrespective of the context.

Read on here [tandfonline.com].

Tuesday, April 19, 2016

OxCARRE Seminars this term

Trinity Term 2016

OxCarre Seminar Series

***Tuesdays at 14.30hrs***

Seminar Room C

Manor Road Building, Manor Road

3 May – 2.30pm Seminar Room C

Speaker: Paul Scott (University of Toulouse)

Title: Dynamic Discrete Choice Estimation of Agricultural Land Use

17 May -2.30pm Seminar Room C

Speaker: Pramila Krishnan (Cambridge)

Title: The Natural Resource Curse Revisited: Theory and evidence from India

31 May – 2 seminars

**1.00pm - Seminar Room D

Speaker: Nicolas Merener (Universidad Torcuato Di Tella, Buenos Aires)

Title: Output Value Risk for Commodity Producers: the Uncertain Benefits of Diversification

**5.30pm – Seminar Room A

Speaker: Joseph Aldy (Harvard)

Title: TBC

14 June – 2.30pm Seminar Room C

Speaker: Martin Weitzman (Harvard)

Title: Can Negotiating a Uniform Carbon Price Help to Internalize the Global Warming Externality?

See further at the OxCARRE website

Friday, April 8, 2016

New Research: Government size, misallocation and the resource curse

Radek Stefanski [weebly.com](University of St. Andrews and external research associate of OxCARRE) writes on

Government size, misallocation and the resource curse

published in Commodity Prices and Macroeconomic Policy, edited by Rodrigo Caputo and Roberto Chang. Santiago, Chile. 2015. Central Bank of Chile. See here [bcentral.cl].

Government size, misallocation and the resource curse

I do two things in this paper: First, using a panel of macro cross-country data, I demonstrate that the share of public sector employment is greater in resource-rich countries than in resource-poor countries even controlling for the size of other non-traded sectors. Second, I construct and calibrate a small, open economy model with two production sectors and a government sector in which (optimally) higher government employment shares emerge as a consequence of windfall-induced labor reallocation. I then use a model to compare the optimal and observed size of government in order to obtain an estimate of the extent of government misallocation and the impact it has on welfare and productivity.Chapter available here [bcentral.cl],

published in Commodity Prices and Macroeconomic Policy, edited by Rodrigo Caputo and Roberto Chang. Santiago, Chile. 2015. Central Bank of Chile. See here [bcentral.cl].

Thursday, April 7, 2016

NRGI launches site with project level payments data

The Natural Resource Governance Institute [resourcegovernance.org] (NRGI) has launches a new website resourceprojects.org, providing project level payment data with the aim to increase transparency in the natural resources sector across the world.

ResourceProjects.org is an open-source repository of data on oil, gas and mining projects across the world. It provides a platform to collect, display, download and search extractive project information using open data. It aims to harvest data on project-by-project payments to governments—based on recent mandatory disclosure legislation in the EU, U.S. and Canada as well as EITI reports—and link it to associated information about the project from a variety of sources. The platform will make it easier for journalists, CSOs, researchers and government officials to search, access and download relevant data.Have a look here [resourceprojects.org] and further explanation here.

FT: Angola goes to IMF

The FT reports:

Angola becomes latest oil producer seeking IMF bailout

Angola becomes latest oil producer seeking IMF bailout

Angola has requested a bailout from the International Monetary Fund that could be worth more than $1.5bn, making the OPEC member the latest oil-producing country to seek international help to cope with the fallout from low crude prices.

Thursday, March 31, 2016

The company that systematically corrupted the global oil industry

Fairfax Media and The Huffington Post publish a 3-part investigative story on corruption on global scale. The first part deals with a Monaco based corporate fixer of contracts for western companies in the Arab world, the second on the caspian region.

Read on here and here [theage.com.au] and follow links under the articles for more details.

A massive leak of confidential documents has for the first time exposed the true extent of corruption within the oil industry, implicating dozens of leading companies, bureaucrats and politicians in a sophisticated global web of bribery and graft.

Read on here and here [theage.com.au] and follow links under the articles for more details.

Friday, March 25, 2016

New Research: Election cycles in natural resource rents: Empirical evidence

Jeroen Klomp ([sites.google.com] University of Wageningen) Jakob de Haan ([rug.nl] University of Groningen) write on

Election cycles in natural resource rents: Empirical evidence

Abstract

Forthcoming in Journal of Development Economics, available here [sciencedirect.com]

Election cycles in natural resource rents: Empirical evidence

Abstract

We examine whether governments’ natural resource rents are affected by upcoming elections and if so, whether the incumbent uses these additional rents for re-election purposes. Estimates of a dynamic panel model for about 60 countries for 1975-2011 suggest that elections increase natural resource rents. The incumbent uses these rents for expanding public spending and reducing taxes before elections. However, these electoral cycle effects are statistically significant only in young democracies. Our results also suggest that election effects are stronger in countries with limited access to free media, limited political checks and balances, and a presidential system.

Forthcoming in Journal of Development Economics, available here [sciencedirect.com]

Wednesday, March 16, 2016

New Research: On the timing of political regime changes in resource-dependent economies

New research from Raouf Boucekkine ([greqam.fr] University of Aix-Marsaille) , Fabien Prieur ([tse-fr.eu], Toulouse School of Economics), Klarizze Puzon (Aix-Marseille School of Economics)

On the timing of political regime changes in resource-dependent economies

Abstract

On the timing of political regime changes in resource-dependent economies

Abstract

We consider a resource-dependent economy initially ruled by the elite. The transition from the autocratic to a more democratic regime takes place only if the citizens decide to revolt against the elite. The occurrence of a revolution primarily depends on the autocratic regime vulnerability and the level of inequalities, both being driven by the elite's redistribution and repression policies. First, we show that when a political transition is inevitable, the elite choose the maximum rate of redistribution to lengthen their period in office. Second, we find that the duration of the autocratic regime is linked to resource abundance, and how it relates to the elite's policies. More resources lead to a shorter reign of a redistributive regime, which may not be the case of a repressive regime. Finally, we interpret the Arab spring sequence in light of our findings.Forthcoming in European Economic Review, Available here [sciencedirect.com].

Tuesday, March 15, 2016

Immigration Policy, Internal Migration and Natural Resource Shocks

A report by Michel Beine, ([michelbeine.be], University of Luxembourg), Robin Boadway, ([queensu.ca], Queen's University, Canada), and Serge Coulombe ([uottawa.ca], University of Ottawa, Canada) for the C.D. Howe institute [cdhowe.org] in Canada,

Moving Parts: Immigration Policy, Internal Migration and Natural Resource Shocks

Report available here [cdhowe.org], and is partly based on earlier research by the two of the authors and yours truly on the effect of migration and resources in Canada, published recently in Economic Journal (here, [wiley.com])

Moving Parts: Immigration Policy, Internal Migration and Natural Resource Shocks

Recent changes to Canadian immigration policy, including the Temporary Foreign Worker (TFW) Program, are positive overall, but they could have negative consequences that need addressing, according to a new C.D. Howe Institute report. In “Moving Parts: Immigration Policy, Internal Migration and Natural Resource Shocks,” authors Michel Beine, Robin W. Boadway and Serge Coulombe note that changes to the TFW Program have limited the kinds of workers companies can bring in, made the applications more rigorous, and set an employer-specific cap on the use of TFWs.

Report available here [cdhowe.org], and is partly based on earlier research by the two of the authors and yours truly on the effect of migration and resources in Canada, published recently in Economic Journal (here, [wiley.com])

Tuesday, March 8, 2016

New Research: Do Resource-Rich Countries Suffer from a Lack of Fiscal Discipline?

Michael Bleaney [University of Nottingham] and Håvard Halland [World Bank] write on

Do Resource-Rich Countries Suffer from a Lack of Fiscal Discipline?

Abstract:

A paper from the World Bank's Governance Global Practice Group, Policy Research Working Paper 7552, available here [pdf, worldbank.org]

Do Resource-Rich Countries Suffer from a Lack of Fiscal Discipline?

Abstract:

Fiscal indicators for resource-rich and resource-poor lowand middle-income countries are compared using annual data from 1996 to 2012. Resource richness is defined by export composition: fuel greater than a 25 percent share and/or ores and metals greater than a 10 percent share. Fuel exporters have a significantly better general government fiscal balance than the rest of the sample, and higher revenues and expenditures, which are approximately evenly split between extra consumption expenditure and extra capital expenditure. Only about a quarter of their extra revenue goes into extra consumption expenditure, and this proportion has been lower since 2005. Fuel exporters’ expenditure reacts with a lag to oil price fluctuations. There are no significant differences between ores and metals exporters and resource-poor countries, or between new and old resource exporters, in aggregate expenditures and revenues. Ores and metals exporters spend more on investment and less on government consumption. Some individual country cases are briefly discussed.

A paper from the World Bank's Governance Global Practice Group, Policy Research Working Paper 7552, available here [pdf, worldbank.org]

Monday, March 7, 2016

New OxCARRE research: Natural Assets: Surfing a wave of economic growth

OxCARRE's Sam Wills and Thomas McGregor write on

Natural Assets: Surfing a wave of economic growth

Abstract

Available on the OxCARRE website, here [pdf]

Natural Assets: Surfing a wave of economic growth

Abstract

Many natural assets can not be valued at market prices. Non-market valuations typically focus on the value of an individual asset to an individual user, ignoring macroeconomic spillovers. We estimate the contribution of a natural asset to aggregate economic activity by exploiting exogenous variation in the quality of surfing waves around the world, using a global dataset covering over 5,000 locations. Treating night-time light emissions as a proxy for economic activity we find that high quality surfing waves boost activity in the local area (<5km), relative to comparable locations with low quality waves, by 0.15-0.28 log points from 1992-2013. This amounts to between US$ 18-22 million (2011 PPP) per wave per year, or $50 billion globally. The e!ect is most pronounced in emerging economies. Surfing helps reduce extreme rural poverty, by encouraging people to nearby towns. When a wave is discovered by the international community, economic growth in the area rises by around 3%.

Available on the OxCARRE website, here [pdf]

Friday, March 4, 2016

New OxCARRE Research: Using Natural Resources for Development: Why Has It Proven So Difficult?

OxCARRE's Director Tony Venables writes on

Using Natural Resources for Development: Why Has It Proven So Difficult?

Forthcoming in the Journal of Economic Perspectives

Abstract

Using Natural Resources for Development: Why Has It Proven So Difficult?

Forthcoming in the Journal of Economic Perspectives

Abstract

Developing economies have found it hard to use natural resource wealth to improve their economic performance. Utilising resource endowments is a multi-stage economic and political problem that requires private investment to discover and extract the resource, fiscal regimes to capture revenue, judicious spending and investment decisions, and policies to manage volatility and mitigate adverse impacts on the rest of the economy. Experience is mixed, with some successes (such as Botswana and Malaysia) and more failures. This paper reviews the challenges that are faced in successfully managing resource wealth, the evidence on country performance, and the reasons for disappointing results.Available from the OxCARRE website, here [pdf]

Friday, February 5, 2016

FT: Oil: From boom to bailout

The FT published an in-depth article about how some countries are coping, and addressing, the recent fall of commodity prices, in particular fossil fuels.

Cheaper crude means many developing countries will take longer to catch up with advanced economies

The problem, says Mr Basu [World Bank chief economist], is that too many producing countries are in denial about the shift or the potential remedies — and are afraid of the political consequences. “It will be very difficult. There’s no getting away from it,” he says.

Thursday, January 28, 2016

New OxCARRE Research: Second-Best Renewable Subsidies to De-Carbonize the Economy: Commitment and the Green Paradox

A new OxCARRE research paper is available from

Armon Rezai (Vienna University of Economics and Business [wu.ac.at]) and

Frederick van der Ploeg (OxCarre, oxcarre.ox.ac.uk)

writing on

Second-Best Renewable Subsidies to De-Carbonize the Economy: Commitment and the Green Paradox

Abstract

Climate change must deal with two market failures: global warming and learning by doing in renewable use. The first-best policy consists of an aggressive renewables subsidy in the near term and a gradually rising and falling carbon tax. Given that global carbon taxes remain elusive, policy makers have to use a second-best subsidy. In case of credible commitment, the second-best subsidy is set higher than the social benefit of learning. It allows the transition time and peak warming close to first-best levels at the cost of higher fossil fuel use (weak Green Paradox). If policy makers cannot commit, the second-best subsidy is set to the social benefit of learning. It generates smaller weak Green Paradox effects, but the transition to the carbon-free takes longer and cumulative carbon emissions are higher. Under first-best and second best with pre-commitment peak warming is 2.1 - 2.3 °C, under second best without commitment 3.5°C, and without any policy temperature 5.1°C above pre-industrial levels. Not being able to commit yields a welfare loss of 95% of initial GDP compared to first best. Being able to commit brings this figure down to 7%.Paper available here [oxcarre.ox.ac.uk]

FT: Azerbaijan may be first to receive assistance from IMF/World Bank following oil price collapse

The FT reports: "IMF and World Bank move to forestall oil-led defaults. Team flies to Azerbaijan over possible $4bn emergency loan" See also here [rferl.org]. The country has been burning through it's foreign reserves, but it's SWF would still have ~ $35bn, 60% of GDP, according to the article.

We've noted the potential difficulties, and economic and political contradictions in Azerbaijan before.

We've noted the potential difficulties, and economic and political contradictions in Azerbaijan before.

Wednesday, January 27, 2016

Yahoo/Bloomberg: Norway to World: We're Sitting Out the Big Wealth Fund Selloff

Yahoo/Bloomberg have a piece in which Egil Matsen (new deputy central bank governor in charge of oversight of the investor and head of the department of economics at NTNU) discusses the strategy of Norway's Sovereign Wealth Fund in the current downturn of oil and equity markets. The strategy? Keep calm and carry on as if nothing is happening.

Read on here [yahoo.com].

Read on here [yahoo.com].

Wednesday, January 20, 2016

VoxEU: The trade consequences of the oil price

Former OxCARRE researchers Pierre-Louis Vézina (King's College, London) and David van Below (Copenhagen Economics) write on VoxEU,

The trade consequences of the oil price

Read on here

The trade consequences of the oil price

The price of oil rose to unprecedented highs in the 2000s, and its recent plunge took many by surprise. Although there are many consequences of such price fluctuations on the world economy, they are notoriously difficult to pin down. This column examines the trade consequences of varying shipping costs caused by oil price fluctuations. High oil prices are found to increase the distance elasticity of trade, making trade less global. The recent drop in oil prices could thus be a boon for globalisation.

Read on here

Tuesday, January 19, 2016

New research: Natural Resource Booms in the Modern Era: Is the curse still alive?

Andrew Warner, IMF, writes on

Natural Resource Booms in the Modern Era: Is the curse still alive?

Abstract

It has a hint of a paper by former OxCARRE Researcher Alexander James [alexandergjames.weebly.com], "The Resource Curse: A Statistical Mirage" (Forthcoming, Journal of Development Economics) View

Natural Resource Booms in the Modern Era: Is the curse still alive?

Abstract

The global boom in hydrocarbon, metal and mineral prices since the year 2000 created huge economic rents - rents which, once invested, were widely expected to promote productivity growth in other parts of the booming economies, creating a lasting legacy of the boom years. This paper asks whether this has happened. To properly address this question the empirical strategy must look behind the veil of the booming sector because that, by definition, will boom in a boom. So the paper considers new data on GDP per person outside of the resource sector. Despite having vast sums to invest, GDP growth per-capita outside of the booming sectors appears on average to have been no faster during the boom years than before. The paper finds no country in which (non-resource) growth per-person has been statistically significantly higher during the boom years. In some Gulf states, oil rents have financed a migration-facilitated economic expansion with small or negative productivity gains. Overall, there is little evidence the booms have left behind the anticipated productivity transformation in the domestic economies. It appears that current policies are, overall, prooving insufficient to spur lasting development outside resource intensive sectors.Full paper here [pdf, img.org]

It has a hint of a paper by former OxCARRE Researcher Alexander James [alexandergjames.weebly.com], "The Resource Curse: A Statistical Mirage" (Forthcoming, Journal of Development Economics) View

Monday, January 18, 2016

The Price of Oil and the Price of Carbon

OxCARRE associate Rabah Arezki and Maurice Obstfeld from the IMF, and also available on the IMFDirect blog here, write on

By Rabah Arezki and Maurice Obstfeld

“The human influence on the climate system is clear and is evident from the increasing greenhouse gas concentrations in the atmosphere, positive radiative forcing, observed warming, and understanding of the climate system.” —Intergovernmental Panel on Climate Change, Fifth Assessment Report

Fossil fuel prices are likely to stay “low for long.” Notwithstanding important recent progress in developing renewable fuel sources, low fossil fuel prices could discourage further innovation in and adoption of cleaner energy technologies. The result would be higher emissions of carbon dioxide and other greenhouse gases.

Policymakers should not allow low energy prices to derail the clean energy transition. Action to restore appropriate price incentives, notably through corrective carbon pricing, is urgently needed to lower the risk of irreversible and potentially devastating effects of climate change. That approach also offers fiscal benefits.

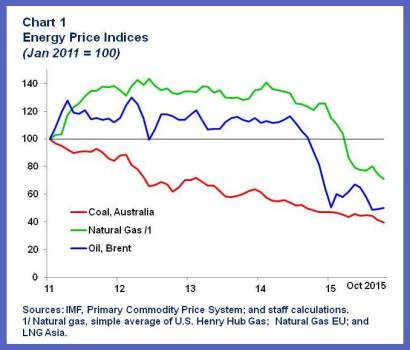

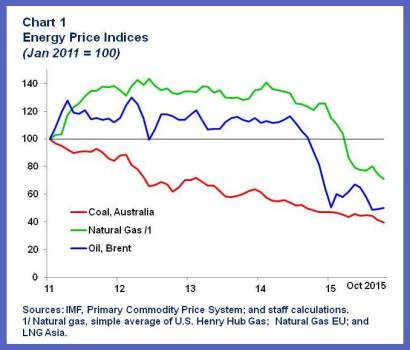

Low for long

Oil prices have dropped by over 60 percent since June 2014 (see Chart 1). A commonly held view in the oil industry is that “the best cure for low oil prices is low oil prices.” The reasoning behind this adage is that low oil prices discourage investment in new production capacity, eventually shifting the oil supply curve backward and bringing prices back up as existing oil fields—which can be tapped at relatively low marginal cost— are depleted. In fact, in line with past experience, capital expenditure in the oil sector has dropped sharply in many producing countries, including the United States. The dynamic adjustment to low oil prices may, however, be different this time around.

Oil prices are expected to remain lower for longer. The advent of shale oil production, made possible by hydraulic fracturing (“fracking”) and horizontal drilling technologies, has added about 4.2 million barrels per day to the crude oil market, contributing to a global supply glut. Shale oil will lead to shorter and more limited oil-price cycles. Indeed, shale requires a lower level of sunk costs than conventional oil, and the lag between first investment and production is much shorter. Furthermore, shale is still at a relatively early stage of its industry life cycle, where the scope for learning is substantial, as shown by production levels that have proven resilient thanks to phenomenal efficiency gains forced by the big drop in oil prices.

In addition, other factors are putting downward pressure on oil prices: change in the strategic behavior of the Organization of Petroleum Exporting Countries, the projected increase in Iranian exports, the scaling down of global demand (especially from emerging markets), the secular drop in petroleum consumption in the United States, and some displacement of oil by substitutes. These likely persistent forces, like the growth of shale, point to a “low for long” scenario, even after the supply legacy left by the high-price era of the 2000s has dissipated. Futures markets, which show only a modest recovery of prices to around $60 a barrel by 2019, support this view.

Natural gas and coal—also fossil fuels—have similarly seen price declines that look to be long-lived. Coal and natural gas are mainly inputs to electricity generation, whereas oil is used mostly to power transportation, yet the prices of all these energy sources are linked, including through oil-indexed contract prices. The North American shale gas boom has resulted in record low prices there. The recent discovery of the giant Zohr gas field off the Egyptian coast will eventually have repercussions on pricing in the Mediterranean region and Europe, and there is significant development potential in many other locales, notably Argentina. Coal prices also are low, owing to oversupply and the scaling down of demand, especially from China, which burns half of the world’s coal.

Renewables at risk

Technological innovations have unleashed the power of renewables such as wind, hydro, solar, and geothermal. Even Africa and the Middle East, home to economies that are heavily dependent on fossil fuel exports have enormous potential to develop renewables. For example, the United Arab Emirates has endorsed an ambitious target to draw 24 percent of its primary energy consumption from renewable sources by 2021.

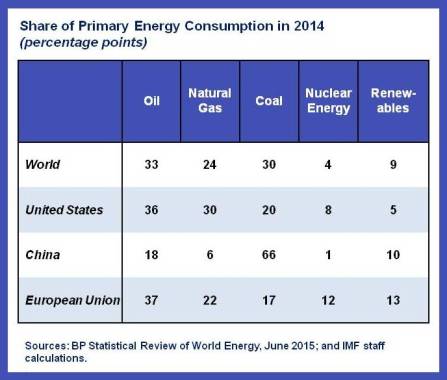

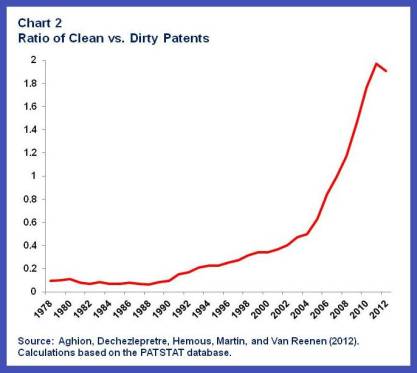

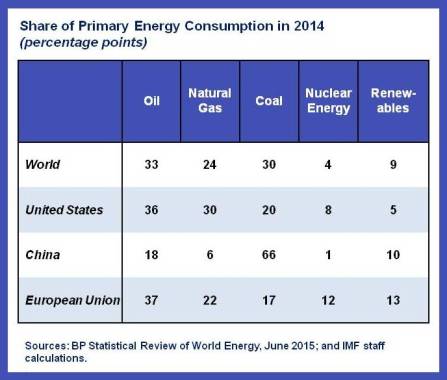

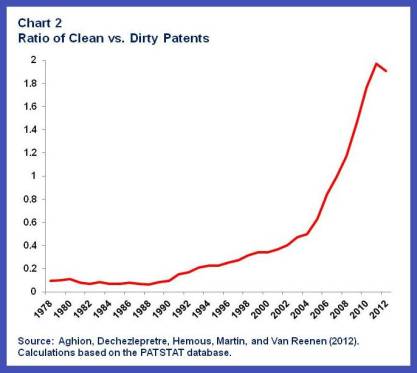

Progress in the development of renewables could be fragile, however, if fossil fuel prices remain low for long. Renewables account for only a small share of global primary energy consumption, which is still dominated by fossil fuels—30 percent each for coal and oil, 25 percent for natural gas (see Table). But renewable energy will have to displace fossil fuels to a much greater extent in the future to avoid unacceptable climate risks. Unfortunately, the current low prices for oil, gas, and coal may provide scant incentive for research to find even cheaper substitutes for those fuels. There is strong evidence that both innovation and adoption of cleaner technology are strongly encouraged by higher fossil fuel prices. The same is true for new technologies for mitigating fossil fuel emissions.

The current low fossil-fuel price environment will thus certainly delay the energy transition. That transition—from fossil fuel to clean energy sources—is not the first one. Earlier transitions were those from wood/biomass to coal in the eighteenth and nineteenth centuries, and from coal to petroleum in the nineteenth and twentieth centuries. One important lesson is that these transitions take a long time to complete. But this time we cannot wait.

We owe to electric lighting the fact that there are still whales in the sea. Unless renewables become cheap enough that substantial carbon deposits are left underground for a very long time, if not forever, the planet will likely be exposed to potentially catastrophic climate risks.

Some climate impacts may already be discernible. For example, the United Nations Children’s Fund estimates that some 11 million children in eastern and southern Africa face hunger, disease, and water shortages as a result of the strongest El Niño weather phenomenon in decades. Many scientists believe that El Niño events, caused by warming in the Pacific, are becoming more intense as a result of climate change.

Getting the price of carbon right

Nations from around the world have gathered in Paris for the United Nations Climate Change Conference, COP-21, with the goal of a universal and potentially legally binding agreement on reducing greenhouse gas emissions. We need very broad participation to address fully the global “tragedy of the commons” that results when countries fail to take into account the negative impact of their carbon emissions on the rest of the world. Moreover, free riding by non-participants, if sufficiently widespread, can undermine the political will to action of participating countries.

The nations participating at COP-21 are focusing on quantitative emissions-reduction commitments (the Intended Nationally Determined Contribution, or INDCs). Economic reasoning shows that the least expensive way for each country to implement its INDC is to put a price on carbon emissions. The reason is that when carbon is priced, those emissions reductions that are least costly to implement will happen first. The IMFcalculates that countries can generate substantial fiscal revenues—revenues that would allow lower distorting taxes and new investments in the economy—by eliminating fossil fuel subsidies and levying carbon charges that capture the domestic damages caused by emissions. A tax on upstream carbon sources is one easy way to put a price on carbon emissions, although some countries may wish to use other methods, such as emissions trading schemes.

Countries that implement their INDCs through a domestic carbon price will reach their goals at lowest cost to themselves, but without global coordination on carbon prices, the cost to the world economy of whatever aggregate emissions reduction is achieved will be unnecessarily high. In order to maximize global welfare, every country’s carbon pricing should reflect not only the purely domestic damages from emissions (for example, health effects of the particulates associated with burning coal), but also the damages to foreign countries.

Setting the right carbon price will therefore efficiently align the costs paid by carbon users with the true social opportunity cost of using carbon. By raising relative demand for clean energy sources, a carbon price would also help to align the market return to clean-energy innovation with its social return, spurring the refinement of existing technologies and the development of new ones. And it would raise the demand for mitigation technologies such as carbon capture and storage, spurring their further development. If not corrected by the appropriate carbon price, low fossil fuel prices are not accurately signaling to markets the true social profitability of clean energy. While alternative estimates of the damages from carbon emissions differ, and it is especially hard to reckon the likely costs of possible catastrophic climate events, most estimates suggest substantial negative effects.

Direct subsidies to R&D have been adopted by some governments but are a poor substitute for a carbon price: they do only part of the job, leaving in place market incentives to over-use fossil fuels and thereby add to the stock of atmospheric greenhouse gases without regard to the collateral costs.

Politically, low oil prices may provide an opportune moment to eliminate subsidies and introduce carbon prices that could gradually rise over time toward efficient levels. However, it is probably unrealistic to aim for the full optimal price in one go. Global carbon pricing will have important redistributive implications, both across and within countries, and these call for gradual implementation, complemented by mitigating and adaptive measures that shield the most vulnerable.

The hope is that the success of the Paris conference opens the door to future international agreement on carbon prices. Agreement on an international carbon-price floor would be a good starting point in that process. Failure to address comprehensively the problem of greenhouse gas emissions, however, exposes all generations, present and future, to incalculable risks.

The Price of Oil and the Price of Carbon

By Rabah Arezki and Maurice Obstfeld

“The human influence on the climate system is clear and is evident from the increasing greenhouse gas concentrations in the atmosphere, positive radiative forcing, observed warming, and understanding of the climate system.” —Intergovernmental Panel on Climate Change, Fifth Assessment Report

Fossil fuel prices are likely to stay “low for long.” Notwithstanding important recent progress in developing renewable fuel sources, low fossil fuel prices could discourage further innovation in and adoption of cleaner energy technologies. The result would be higher emissions of carbon dioxide and other greenhouse gases.

Policymakers should not allow low energy prices to derail the clean energy transition. Action to restore appropriate price incentives, notably through corrective carbon pricing, is urgently needed to lower the risk of irreversible and potentially devastating effects of climate change. That approach also offers fiscal benefits.

Low for long

Oil prices have dropped by over 60 percent since June 2014 (see Chart 1). A commonly held view in the oil industry is that “the best cure for low oil prices is low oil prices.” The reasoning behind this adage is that low oil prices discourage investment in new production capacity, eventually shifting the oil supply curve backward and bringing prices back up as existing oil fields—which can be tapped at relatively low marginal cost— are depleted. In fact, in line with past experience, capital expenditure in the oil sector has dropped sharply in many producing countries, including the United States. The dynamic adjustment to low oil prices may, however, be different this time around.

Oil prices are expected to remain lower for longer. The advent of shale oil production, made possible by hydraulic fracturing (“fracking”) and horizontal drilling technologies, has added about 4.2 million barrels per day to the crude oil market, contributing to a global supply glut. Shale oil will lead to shorter and more limited oil-price cycles. Indeed, shale requires a lower level of sunk costs than conventional oil, and the lag between first investment and production is much shorter. Furthermore, shale is still at a relatively early stage of its industry life cycle, where the scope for learning is substantial, as shown by production levels that have proven resilient thanks to phenomenal efficiency gains forced by the big drop in oil prices.

In addition, other factors are putting downward pressure on oil prices: change in the strategic behavior of the Organization of Petroleum Exporting Countries, the projected increase in Iranian exports, the scaling down of global demand (especially from emerging markets), the secular drop in petroleum consumption in the United States, and some displacement of oil by substitutes. These likely persistent forces, like the growth of shale, point to a “low for long” scenario, even after the supply legacy left by the high-price era of the 2000s has dissipated. Futures markets, which show only a modest recovery of prices to around $60 a barrel by 2019, support this view.

Natural gas and coal—also fossil fuels—have similarly seen price declines that look to be long-lived. Coal and natural gas are mainly inputs to electricity generation, whereas oil is used mostly to power transportation, yet the prices of all these energy sources are linked, including through oil-indexed contract prices. The North American shale gas boom has resulted in record low prices there. The recent discovery of the giant Zohr gas field off the Egyptian coast will eventually have repercussions on pricing in the Mediterranean region and Europe, and there is significant development potential in many other locales, notably Argentina. Coal prices also are low, owing to oversupply and the scaling down of demand, especially from China, which burns half of the world’s coal.

Renewables at risk

Technological innovations have unleashed the power of renewables such as wind, hydro, solar, and geothermal. Even Africa and the Middle East, home to economies that are heavily dependent on fossil fuel exports have enormous potential to develop renewables. For example, the United Arab Emirates has endorsed an ambitious target to draw 24 percent of its primary energy consumption from renewable sources by 2021.

Progress in the development of renewables could be fragile, however, if fossil fuel prices remain low for long. Renewables account for only a small share of global primary energy consumption, which is still dominated by fossil fuels—30 percent each for coal and oil, 25 percent for natural gas (see Table). But renewable energy will have to displace fossil fuels to a much greater extent in the future to avoid unacceptable climate risks. Unfortunately, the current low prices for oil, gas, and coal may provide scant incentive for research to find even cheaper substitutes for those fuels. There is strong evidence that both innovation and adoption of cleaner technology are strongly encouraged by higher fossil fuel prices. The same is true for new technologies for mitigating fossil fuel emissions.

The current low fossil-fuel price environment will thus certainly delay the energy transition. That transition—from fossil fuel to clean energy sources—is not the first one. Earlier transitions were those from wood/biomass to coal in the eighteenth and nineteenth centuries, and from coal to petroleum in the nineteenth and twentieth centuries. One important lesson is that these transitions take a long time to complete. But this time we cannot wait.

We owe to electric lighting the fact that there are still whales in the sea. Unless renewables become cheap enough that substantial carbon deposits are left underground for a very long time, if not forever, the planet will likely be exposed to potentially catastrophic climate risks.

Some climate impacts may already be discernible. For example, the United Nations Children’s Fund estimates that some 11 million children in eastern and southern Africa face hunger, disease, and water shortages as a result of the strongest El Niño weather phenomenon in decades. Many scientists believe that El Niño events, caused by warming in the Pacific, are becoming more intense as a result of climate change.

Getting the price of carbon right

Nations from around the world have gathered in Paris for the United Nations Climate Change Conference, COP-21, with the goal of a universal and potentially legally binding agreement on reducing greenhouse gas emissions. We need very broad participation to address fully the global “tragedy of the commons” that results when countries fail to take into account the negative impact of their carbon emissions on the rest of the world. Moreover, free riding by non-participants, if sufficiently widespread, can undermine the political will to action of participating countries.

The nations participating at COP-21 are focusing on quantitative emissions-reduction commitments (the Intended Nationally Determined Contribution, or INDCs). Economic reasoning shows that the least expensive way for each country to implement its INDC is to put a price on carbon emissions. The reason is that when carbon is priced, those emissions reductions that are least costly to implement will happen first. The IMFcalculates that countries can generate substantial fiscal revenues—revenues that would allow lower distorting taxes and new investments in the economy—by eliminating fossil fuel subsidies and levying carbon charges that capture the domestic damages caused by emissions. A tax on upstream carbon sources is one easy way to put a price on carbon emissions, although some countries may wish to use other methods, such as emissions trading schemes.

Countries that implement their INDCs through a domestic carbon price will reach their goals at lowest cost to themselves, but without global coordination on carbon prices, the cost to the world economy of whatever aggregate emissions reduction is achieved will be unnecessarily high. In order to maximize global welfare, every country’s carbon pricing should reflect not only the purely domestic damages from emissions (for example, health effects of the particulates associated with burning coal), but also the damages to foreign countries.

Setting the right carbon price will therefore efficiently align the costs paid by carbon users with the true social opportunity cost of using carbon. By raising relative demand for clean energy sources, a carbon price would also help to align the market return to clean-energy innovation with its social return, spurring the refinement of existing technologies and the development of new ones. And it would raise the demand for mitigation technologies such as carbon capture and storage, spurring their further development. If not corrected by the appropriate carbon price, low fossil fuel prices are not accurately signaling to markets the true social profitability of clean energy. While alternative estimates of the damages from carbon emissions differ, and it is especially hard to reckon the likely costs of possible catastrophic climate events, most estimates suggest substantial negative effects.

Direct subsidies to R&D have been adopted by some governments but are a poor substitute for a carbon price: they do only part of the job, leaving in place market incentives to over-use fossil fuels and thereby add to the stock of atmospheric greenhouse gases without regard to the collateral costs.

Politically, low oil prices may provide an opportune moment to eliminate subsidies and introduce carbon prices that could gradually rise over time toward efficient levels. However, it is probably unrealistic to aim for the full optimal price in one go. Global carbon pricing will have important redistributive implications, both across and within countries, and these call for gradual implementation, complemented by mitigating and adaptive measures that shield the most vulnerable.

The hope is that the success of the Paris conference opens the door to future international agreement on carbon prices. Agreement on an international carbon-price floor would be a good starting point in that process. Failure to address comprehensively the problem of greenhouse gas emissions, however, exposes all generations, present and future, to incalculable risks.

New OxCARRE Research Papers

Rabah Arezki [imf.org], Patrick Bolton [columbia.edu], Sanjay Peters [columbia.edu, Copenhagen Business School], Frederic Samama (Amundi Asset Management) & Joseph Stiglitz [columbia.edu, Columbia University] write on

From Global Savings Glut to Financing Infrastructure: The Advent of Investment Platforms

Abstract

and

Rabah Arezki [imf.org] and Thiemo Fetzer [University of Warwick trfetzer.com] write on

On the Comparative Advantage of U.S. Manufacturing: Evidence from the Shale Gas Revolution

From Global Savings Glut to Financing Infrastructure: The Advent of Investment Platforms

Abstract

This paper investigates the emerging global landscape for public-private coinvestments in infrastructure. The creation of the Asian Infrastructure Investment Bank and other so-called “infrastructure investment platforms” are an attempt to tap into the pool of both public and private long-term savings in order to channel the latter into much needed infrastructure projects. This paper puts these new initiatives into perspective by critically reviewing the literature and experience with public private partnerships in infrastructure. It concludes by identifying the main challenges policy makers and other actors will need to confront going forward and to turn infrastructure into an asset class of its own.Full paper at OxCARRE website here [pdf, oxcarre.ox.ac.uk].

and

Rabah Arezki [imf.org] and Thiemo Fetzer [University of Warwick trfetzer.com] write on

On the Comparative Advantage of U.S. Manufacturing: Evidence from the Shale Gas Revolution

This paper provides the first empirical evidence of the newly found comparative advantage of the United States manufacturing sector following the so-called shale gas revolution. The revolution has led to (very) large and persistent differences in the price of natural gas between the United States and the rest of the world owing to the physics of natural gas. Results show that U.S. manufacturing exports have grown by about 6 percent on account of their energy intensity since the onset of the shale revolution. We also document that the U.S. shale revolution is operating both at the intensive and extensive margins.Full paper at OxCARRE website here [pdf, oxcarre.ox.ac.uk].

OxCARRE Seminars this term

See also the OxCARRE website

Title: Carbon Dating: When is it beneficial to link ETSs?

Title: Common Pool Resources Across National Borders

Title: Factor Mobility and Optimal Monetary Policy in Commodity-Exporting Economies

Title: The Shifting Frontier of Natural Resources

Title: TBC

Title: TBC

Hilary Term 2016

OxCarre Seminar Series

Tuesdays at ***14.30hrs***

(unless otherwise stated*)

Seminar Room C,

Manor Road Building (Second Floor), Manor Road, Oxford OX1 3UQ

***Seminars will now take place at 14.30hrs

26 January

2 February - 3.00pm at Institute for New Economic Thinking, Eagle House, Walton Well Road, Oxford. – this seminar is being held jointly with INET.

Speaker: Luca Taschini (Grantham Institute, LSE)Title: Carbon Dating: When is it beneficial to link ETSs?

9 February

1 March

8 March

Speaker: Kyle Meng (Univeristy of California, Santa Barbara)

Title: Global Trade and Risk Sharing in a Spatially Correlated Climate

Title: Global Trade and Risk Sharing in a Spatially Correlated Climate

OxCarre Lunchtime Seminar Series

Wednesdays at 12noon

(unless otherwise stated*)

Seminar Room D,

Manor Road Building (Second Floor), Manor Road, Oxford OX1 3UQ

3 February

Speaker: Jim Cust (NRGI)Title: Common Pool Resources Across National Borders

17 February

Speaker: Tara Iyer (OxCarre)Title: Factor Mobility and Optimal Monetary Policy in Commodity-Exporting Economies

24 February

Speaker: Rick van der Ploeg (OxCarre)Title: The Shifting Frontier of Natural Resources

2 March

Speaker: Alex Schmitt (CESifo)Title: TBC

9 March

Speaker: Gerhard Toews (OxCarre)Title: TBC

Subscribe to:

Posts (Atom)